When I traded small-caps I was always a little jealous of the profitable momo traders that made enough money to justify a TradeIdeas subscription and a popper scanner that instantly alerted when a stock started gaining momentum, whether from news, technical analysis, or just plain pump and dumps.

I had tried creating a custom watchlist based on a scan that would show the top percent gainers, but ToS has some severe limitations with scan-based watchlists in that they would only update every two to three minutes.

Two minutes in momentum trading might as well be two hours. You missed the move, go home.

I spent a lot of time banging my head against the limitations in ToS but this seemed like it should be possible, there must be a way to get real-time results for percent gainers.

Then I discovered custom watchlist columns, and Yo Momo was born.

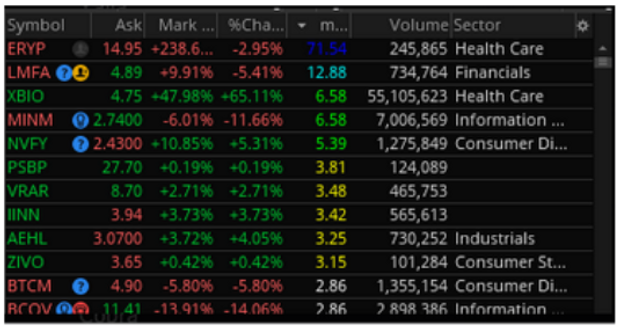

Turns out, this was exactly the key I needed to unlock my problem, all I had to do was calculate the percent change in the watchlist column and just sort on that. And then color them in a rainbow so it looked pretty when sorted but if I was sorting by something else, the color would give me a quick indication of that ticker’s current momo, the percent change over the rolling period.

Something with a high percent change right this second will pop to the top instantaneously, and will stay on the list even if it cools a bit rather than falling off once the initial spike is done thanks to the rolling range.

The other key (there were two keys) was the watchlist scan: I still pick up the top percent gainers, but rather than trying to show just the top 50 or so, I tweaked the scan settings to show the top 1,000 small-caps within minimum price and volume ranges. In premarket I’d use my Upgappers Scan and at the bell I’d switch to my % Gainers Scan. I also had a Momo Scan I’d use.

Why 1000? Because there’s another ToS limitation: you can only have 1100 custom watchlist column calculations across the entire application. Meaning, if you used only this column, you could see about 1100 before it started throwing errors. If you used this column and another custom column on the same watch list (they’re the ones with script icons next to their names in the list) then you’d max at about 550 items before you’d see calculation errors.

This scan would pretty reliably return the entire list of small-caps I was interested in, and my watchlist column would then sort them in real time as their percent changed. I could even negative sort for the massive losers to find knife-catching opportunities.

Originally I set the watchlist column period to 1m and the range at 1m but then I found that it would ‘reset’ the winners every minute because at the new candle their percent change was all equal again. Besides, the signal to noise ratio was showing me a lot of garbage movement, transient purchases that, while significant, didn’t signal a momentum breakout.

What I wanted was a ‘rolling’ range, and through trial and error I settled on looking at the last ten three-minute candles. The idea was, it didn’t so much matter what period candle I looked at as long as it was a rolling range to smooth out the ‘resets’ when candles rolled over. I also wanted to be able to incorporate the updated watchlist scan results as quickly as ToS would allow, thus the 3m candle period on the watchlist.

This gave me a rolling 30m period which cut the noise down considerably. Now I’d see runners pop to the top almost immediately, and sometimes before TradeIdeas even. It was like magic.

I made a tweaked version called Yo Momo So Loud that had all the same values but changed the background color based on relative volume, so higher RVOL was green and lower was red.

I know people who tweak the script to show the last five 1m candles as they don’t mind the additional noise. Right now I have a 15m, 30m, and 90m on my short list of large caps so I can see which one of them is currently seeing action and where they’ve been recently.

If I was trapped trading small caps on a desert island and I could bring only one ToS thing with me, it would without question be Yo Momo.